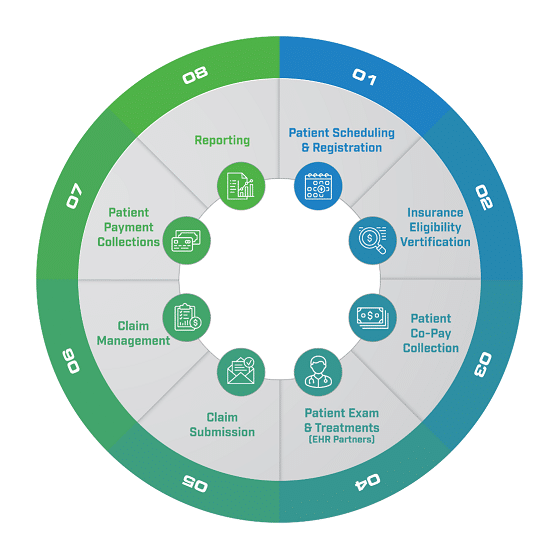

The revenue cycle starts when your patient first schedules an appointment and ends when their balance is paid in full. It is a complex system that is built of many different influencing factors, each of which can be broken down and improved.

Providers looking to address their revenue cycle management need to be open to the idea that change is the answer. While some processes might be able to be completed in house, that is not always what’s best. The real answer to addressing your revenue cycle management and making sustainable improvements involves partnering with a Revenue Cycle Management services vendor, making changes in your claims management process, introducing new tools, and improving your workflow to optimize your revenue cycle this year.

How to Improve Revenue Cycle Management:

1) Choose the Right Partner

There is a plethora of partners that offer Revenue Cycle Management services who claim they can make a difference in your practice. They cannot all be the best, though. Choosing the right partner determines whether or not your practice will see success when they go to outsource services.

Choosing a trusted vendor means improving your practice’s revenue cycle management in multiple ways. First, the right vendor of services will work with your practice to maximize your clean claims to an average of 99%. They will also work hard to make sure your practice collects more on difficult patient payments. Choosing the right partner for Revenue Cycle Management services means passing off some of the most time-consuming billing processes to a team of expert professionals. Ask any potential vendor so show proof that they have done this for other organizations.

2) Improve Claims Management

Claims management is the means of processing a medical claim from start to finish. While the hope is that each claim you file would be approved the first time, denials happen quite often to providers who are running in-house revenue cycle management. Improving your claims management processes is an important step to optimizing Revenue Cycle Management at your practice and improving your bottom line.

Tools like claims tracking can be found in a quality medical billing software. This allows you to track your claim from start to finish and notice it immediately if it is denied for whatever reason. This allows for a quick turnaround so the claim can be resubmitted. Other claims management resources include your RCM services partner who can scrub your claims before they are submitted to target any potential denials ahead of time.

3) Verify Coverage at Every Chance

Even if the patient was in for a visit recently, it is still important to reverify their coverage. Without proper coverage, providers can end up rendering services that patients are not insured to receive. This leaves the patient responsible for the payment, and it is much harder to get an in-full payment from the patient than from their insurance company.

For this reason, the provider must verify coverage at every given opportunity to ensure their patients are covered for the services they are about to offer. With the right partner, your revenue cycle management will improve with tools like prior authorization and automated insurance verification.

4) Automated Processes

Including automated insurance verification and prior authorization, providers need to implement an increasing number of automated processes if they want to optimize Revenue Cycle Management. By digitizing many traditionally papered processes, providers can increase efficiency in their claims management and payment processing to improve their revenue cycle.

Other automated processes include bulk claims processes that enable providers to bill by the payer at different times of the month to optimize their payments. Tools also include automated payment processing integrated into your practice’s patient portal to promote an increased number of patient payments.

Outsourcing Revenue Cycle Management services at your practice may be the answer to financial growth for your practice this year. To learn more, click here.