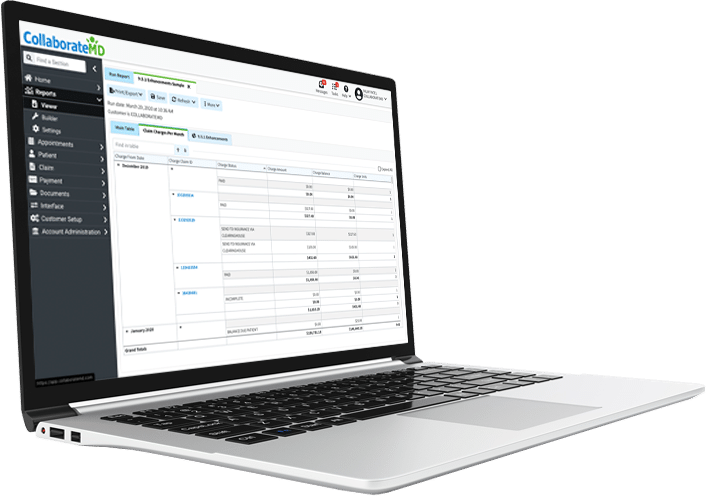

Cloud-Based

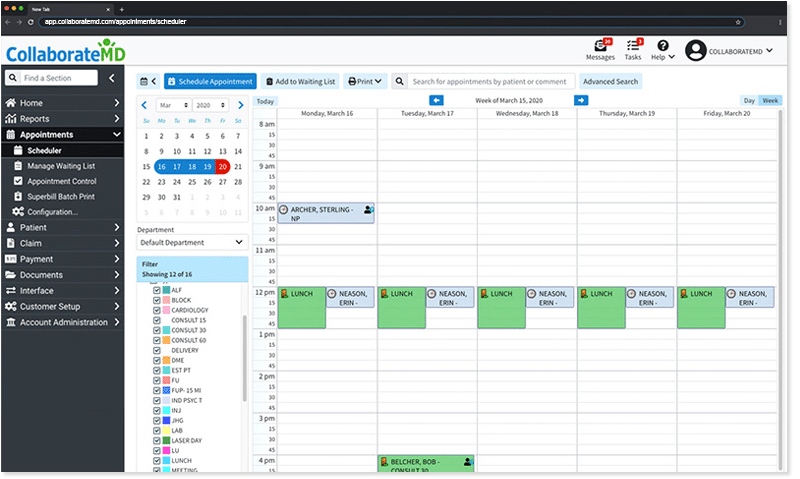

Practice Management & Medical Billing

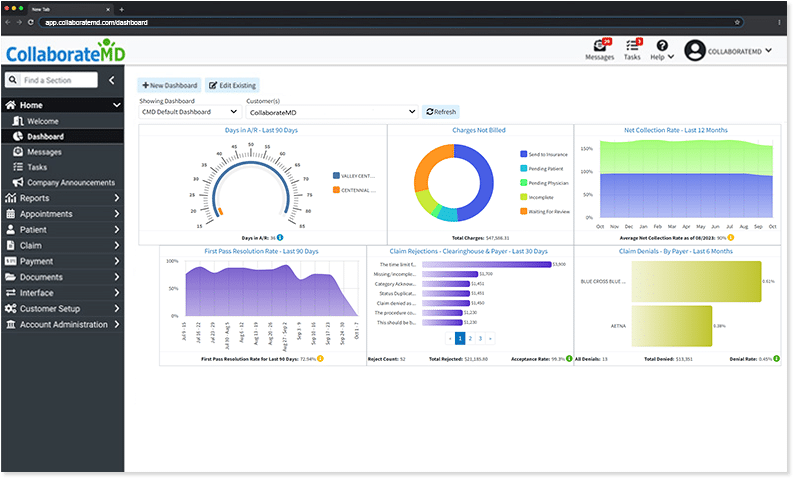

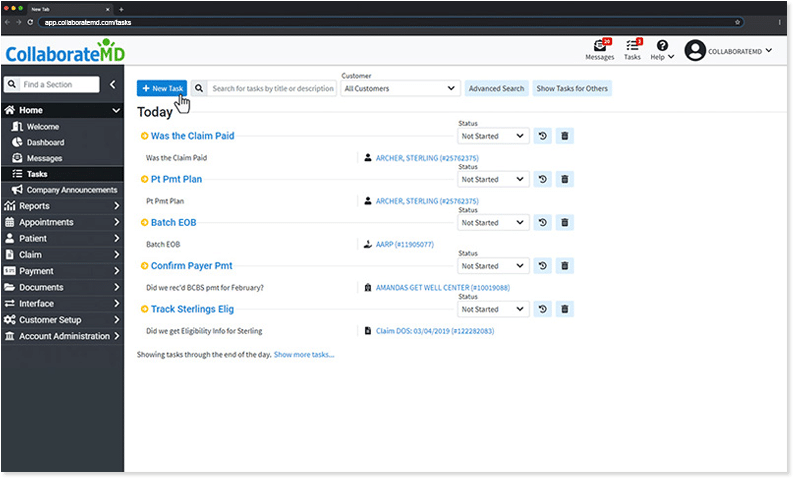

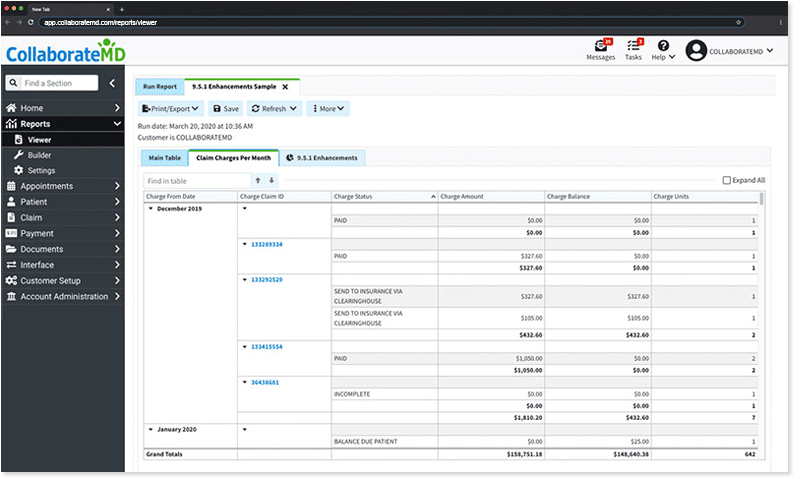

CollaborateMD delivers a cloud-based practice management and medical billing software that avoids complicated workflows in the front office and simplifies the billing process for the back office. Detailed analytics offer you visual insights to key information that keeps your practice running at a high level of efficiency. Now you can get back to what matters most, patient care.